How Sports and Entertainment Projects Are Reshaping Property Values

in Pakistan

Sports and entertainment

developments play a key role in urban growth. Projects such as stadiums,

recreational parks, and entertainment districts transform how areas function

and attract activity. They draw residents, visitors, and businesses, which directly

influences real estate demand. For property buyers and investors, understanding

this connection is essential. When planned and executed well, these projects

can significantly increase the value of nearby residential and commercial

properties.

Why sports and entertainment developments influence real

estate value

Major sports

and entertainment projects act as magnets for activity. They bring consistent

visitor traffic, event crowds, and daily users into an area. This steady flow

of people increases demand for housing, retail, and services.

Stadiums, arenas, public parks,

and entertainment zones turn quiet locations into active centers. Higher

footfall encourages businesses to invest nearby. Shops, restaurants, hotels,

and offices open to serve this demand. As commercial activity grows,

residential interest follows. Buyers and tenants look for convenient living

options close to these hubs, which pushes property prices and rental values

upward.

Key factors

that increase property value

How proximity and development shape property prices

Properties

located within one to three kilometers of major sports or entertainment

projects see the strongest impact. Shorter travel times matter to buyers and

tenants. Easy access increases convenience, which allows sellers and landlords

to command higher prices. Rental demand also increases due to regular events

and daily visitor traffic.

Role of infrastructure

improvements

Large

projects usually trigger public investment in surrounding infrastructure. Roads

are widened. Parking facilities improve. Street lighting becomes better. Public

transport routes expand. These upgrades make the area easier to live in and

move around. As livability improves, property values naturally rise.

Business activity and economic

spillover

New venues

attract commercial interest. Restaurants, cafés, hotels, retail outlets, and

offices open to serve visitors and employees. This mixed commercial growth

strengthens the local economy. Residential plots and apartments in these zones

gain premium status due to higher demand and better services.

Impact on rental income

Sports

and entertainment hubs create multiple rental opportunities. Short term rentals

perform well during tournaments, concerts, and festivals. Long term rentals

attract professionals, retail staff, and service workers who prefer to live

close to work. In many cases, rental yields in these areas grow faster than the

city average.

Area image and market perception

Locations associated with major

venues gain strong market recognition. Buyers link these areas with

development, lifestyle, and future growth. This positive image increases buyer

confidence. Even without immediate income gains, perception alone can push

property prices higher over time.

How different developments influence nearby property

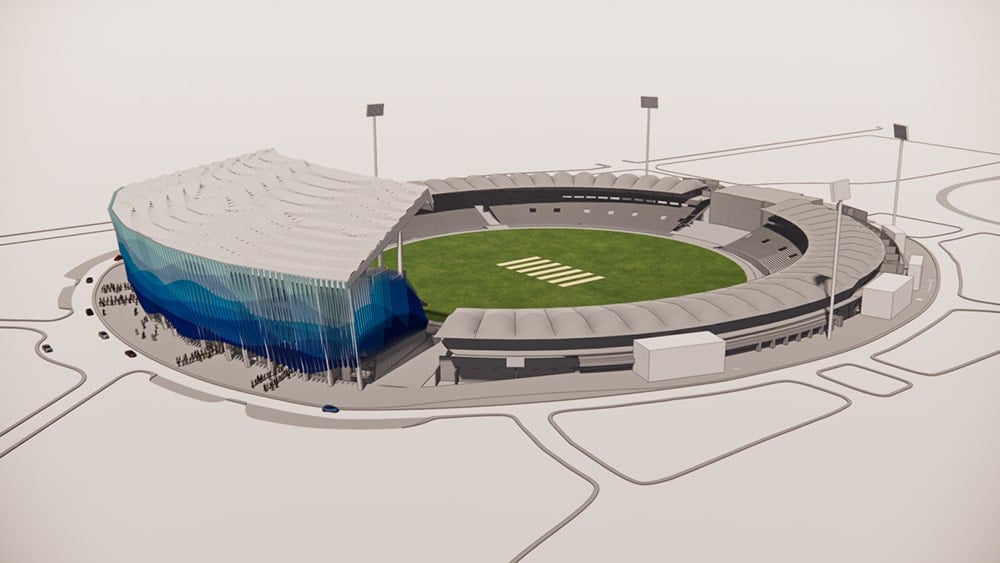

Impact of large sports venues

Sports

stadiums often raise land values for apartments, hotels, and retail outlets

around them. Events create sharp spikes in rental demand, especially during

tournaments and concerts. However, success depends on proper parking, road

access, and crowd management. Well planned stadium zones perform far better

than poorly connected ones.

Effect of entertainment focused

districts

Entertainment

districts bring steady daily activity. Cinemas, food streets, and family attractions

increase footfall throughout the week, not only during special events. This

stability supports consistent commercial rents. Nearby residential properties

appeal strongly to young professionals and small families who value lifestyle

and convenience.

Value of urban parks and

recreational areas

Public parks

and recreational spaces improve overall quality of life. Families prioritize

access to open green areas, walking tracks, and play zones. Property values

near parks usually rise at a steady pace rather than sudden jumps. Long term

appreciation remains reliable and less volatile.

Performance of mixed use sports

complexes

Mixed

use sports complexes combine venues, retail, offices, and housing in one

integrated area. These developments create self sufficient neighborhoods.

Residents can live, work, and socialize within the same zone. Property prices

in such areas often outperform surrounding localities due to strong demand and

limited supply.

Pakistan market factors you

should consider

Public

sector led projects signal long term government commitment. Investors see these

developments as lower risk. Property prices often begin rising well before

project completion once funding and approvals become clear.

Private

developer led projects usually progress faster. They can offer higher returns

for early investors. Risk is also higher, so careful due diligence on

approvals, financing, and timelines is essential.

Major

cities such as Lahore, Karachi, and Islamabad show the strongest and fastest

impact on property values. Secondary cities experience similar benefits, but

usually after a time lag.

Key risks you need to evaluate

Traffic

and accessibility issues can reduce livability if planning is weak. Always

assess road capacity and entry and exit points.

Noise

levels and crowd pressure can affect comfort. Properties at a moderate distance

tend to perform better than those immediately adjacent to venues.

Project

delays can slow or stall price appreciation. Avoid speculative pricing when

timelines are uncertain or repeatedly extended.

Smart strategies for property

investors

Enter after key approvals but

before project completion to capture upside.

Prioritize properties with strong road access and public transport

connectivity.

Select properties that work for both rental income and resale.

Avoid paying inflated prices during hype driven launches.

Monitor government development plans, budgets, and zoning updates to stay ahead

of market shifts.

Sports and

entertainment developments can create strong real estate opportunities when

planning and execution are sound. They bring people, improve infrastructure,

and stimulate commercial activity, which directly increases property demand.

For you as a buyer or investor, results depend on smart timing, careful

location selection, and realistic risk evaluation. Focus on projects with clear

approvals, reliable timelines, and good access. When you balance proximity with

livability and long term use, your property stands a much better chance of

delivering consistent appreciation and stable returns over time.

FAQs

Do sports and entertainment

projects always increase property value?

No, Value increases when projects have clear approvals, strong access, and

supporting infrastructure. Poor planning limits upside.

How close should you buy to a

stadium or entertainment zone?

One to three kilometers works best. You get access benefits without noise and

congestion issues.

When is the best time to invest

near these projects?

After official approvals and funding confirmation, but before completion. This

phase offers better pricing with lower risk.

Are rental returns higher near

these developments?

Yes in many cases. Event based demand supports short term rentals. Daily

activity supports long term tenants. Returns often exceed nearby areas.

Do public sector projects perform

better than private ones?

Public projects offer stability and long term confidence. Private projects can

deliver faster gains but require stronger due diligence.

Which property types benefit the

most?

Apartments, mixed use units, and small commercial spaces perform well.

Flexibility improves resale and rental potential.

What risks should you watch

closely?

Traffic planning, noise levels, project delays, and inflated launch prices.

Always review approvals and access see plans.

Do

these projects benefit secondary cities in Pakistan?

Yes but with a delay. Major cities see faster impact. Secondary cities follow

once supporting infrastructure develops.